The crisis engulfing one of the world’s biggest stablecoins has worsened, inflaming regulators’ concerns over the assets that underpin the global cryptocurrency market.

The episode has poured fresh fuel on worries among financial regulators over the rising risks the $180 billion stablecoin industry poses to traditional markets as crypto becomes more integrated with conventional payments and banking systems.

“A stablecoin known as TerraUSD experienced a run and declined in value,” US Treasury secretary Janet Yellen said last week. “I think that this simply illustrates that this is a rapidly growing product and there are rapidly growing risks.”

Stablecoins are meant to provide a safe harbour for crypto investors, allowing them to stash digital cash and hop easily between different cryptocurrencies.

Generally, they claim to be backed by a basket of dollar assets. Terra, which ranked among the top-five stablecoins on the market at the start of this week, is different.

It is a so-called algorithmic stablecoin, which seeks to track the buck by raising or cutting the amount of its coin in circulation as it diverges from the dollar’s value, in part through a relationship with Luna, a cryptocurrency.

Whatever the structure behind stablecoins, regulators have been concerned about their role for some time.

The Federal Reserve, European Central Bank and Bank of England have all issued warnings on the risks of stablecoins, and particularly on their links to the traditional financial system

TerraUSD and the missing bitcoin

Last week saw the collapse of TerraUSD (UST), the algorithmic stablecoin created by Terraform Labs. Intended to maintain a peg to the US Dollar, the value of 1 UST plummeted from $1 to a low of just $0.04, leading to billions of dollars in losses for UST holders.

Following the collapse of Terra’s UST stablecoin, questions have been asked about the fate of the $3.5 billion in bitcoin held in reserve to help prevent exactly such an outcome.

Perhaps foreseeing the failure of the mechanism intended to maintain the peg, Luna Foundation Guard (LFG), a non-profit organisation formed to support the growth of the Terra ecosystem, announced that it would purchase up to $10 billion in bitcoin and other cryptocurrencies, to act as a reserve that would back the UST stablecoin.

Between January and May this year, 80,394 BTC worth $3.5 billion at the time, were purchased by LFG.

When the value of UST began to drop on 9th May, LFG announced that it would begin to dispose of its bitcoin reserves and purchase UST – in order to try to maintain UST’s peg to the US Dollar.

Over the course of the next day the bitcoin addresses holding LFG’s reserves were emptied. As the UST stablecoin’s value has continued to plummet, questions have been asked about the fate of the LFG bitcoin reserve, and whether it was really used to support the stablecoin’s value.

Here we use Elliptic’s blockchain analytics software to follow the money trail and discover the fate of the LFG bitcoins.

On the morning of 9th May, LFG announced that it would “Loan $750M worth of BTC to OTC trading firms to help protect the UST peg”. Terra creator Do Kwon later clarified that the bitcoin would be “used to trade”.

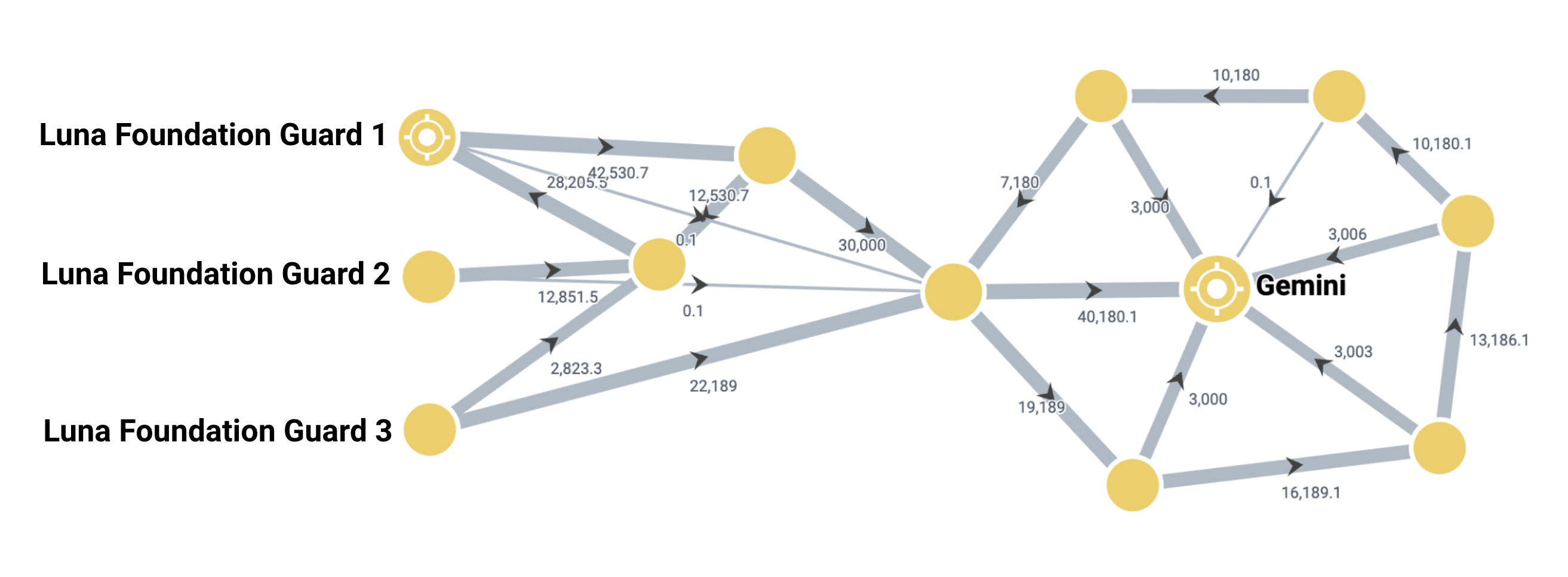

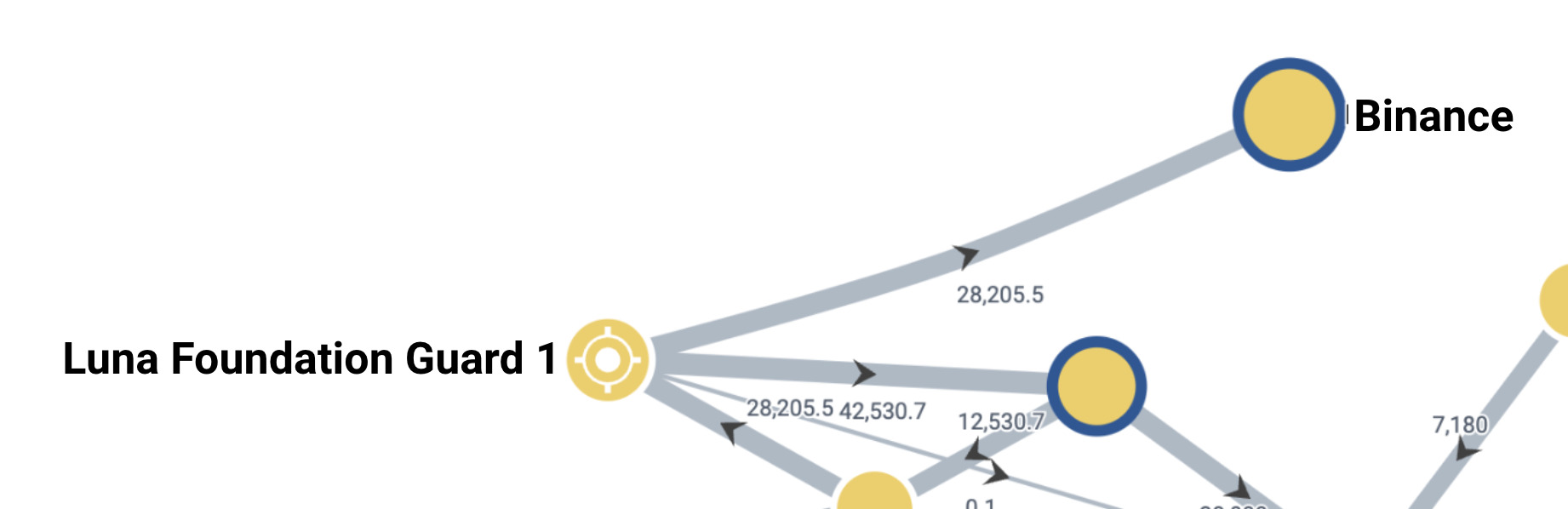

At around the same time, 22,189 BTC (worth ~$750 million at this time) was sent from a Bitcoin address linked to LFG, to a new address. Later that evening a further 30,000 BTC (worth ~$930 million at the time) was sent from other LFG wallets, to this same address.

Within hours the entirety of this 52,189 BTC was subsequently moved to a single account at Gemini, the US-based crypto currency exchange – across several bitcoin transactions. It is not possible to trace the assets further or identify whether they were sold to support the UST price.

This left 28,205 BTC in Terra’s reserves. At 1am UTC on 10th May, this was moved in its entirety, in a single transaction, to an account at the cryptocurrency exchange Binance. Again it is not possible to identify whether these assets were sold or subsequently moved to other wallets.

Those seeking to recoup losses suffered through their exposure to UST may be interested to determine whether these bitcoins remain held on these exchanges.

Pert of this article was previously published on the Elliptic website

The post Stablecoins crisis – What happened to the $3.5 billion Terra reserve? appeared first on Payments Cards & Mobile.