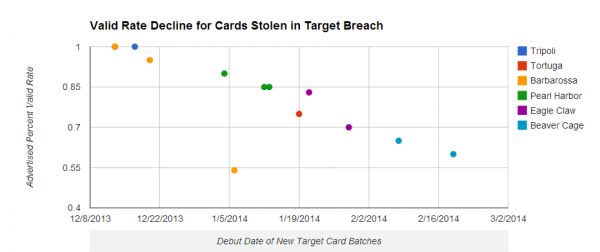

Last year’s Target breach flooded underground markets with millions of stolen credit and debit cards. In the days surrounding the breach disclosure, the cards carried unusually high price tags — in large part because few banks had gotten around to cancelling any of them yet.

Today, two months after the breach, the number of unsold stolen cards that haven’t been cancelled by issuing banks is rapidly shrinking, forcing the miscreants behind this historic heist to unload huge volumes of cards onto underground markets and at cut-rate prices – reports Krebs on Security.

Cards stolen in the Target breach have become much cheaper as more of them come back declined or cancelled by issuing banks.

Earlier today, the underground card shop Rescator[dot]so moved at least 2.8 million cards stolen from U.S.-based shoppers during the Target breach. This chunk of cards, dubbed “Beaver Cage” by Rescator, was the latest of dozens of batches of cards stolen from Target that have gone on sale at the shop since early December.

The Beaver Cage batch of cards have fallen in price by as much as 70 percent compared to those in “Tortuga,” a huge chunk of several million cards stolen from Target that sold for between $26.60 and $44.80 apiece in the days leading up to Dec. 19 – the day that Target acknowledged a breach.

Today, those same cards are now retailing for prices ranging from $8 to $28. The oldest batches of cards stolen in the Target breach –i.e., the first batches of stolen cards sold –are at the top of legend in the graphic above; the “newer,” albeit less fresh, batches are at the bottom.

The core reason for the price drop appears to be the falling “valid rate” associated with each batch. Cards in the Tortuga base were advertised as “100 percent valid,” meaning that customers who bought ten cards from the store could expect all 10 to work when they went to use them at retailers to purchase high-priced electronics, gift cards and other items that can be quickly resold for cash.

This latest batch of Beaver Cage cards, however, carries only a 60 percent valid rate, meaning that on average customers can expect at least 4 out of every 10 cards they buy to come back declined or canceled by the issuing bank.

The most previous batch of Beaver Cage cards — pushed out by Rescator on Feb. 6 — included nearly 4 million cards stolen from Target and carried a 65 percent valid rate. Prior to Beaver Cage, the Target cards were code-named “Eagle Claw.” On Jan. 29, Rescator debuted 4 million cards bearing the Eagle Claw name and a 70 percent valid rate. The first two batches of Eagle Claw-branded cards — a chunk of 2 million cards — were released on Jan. 21 with a reported 83 percent valid rate.

Rescator[dot]so card shop announcing the availability of new bases of Target cards.

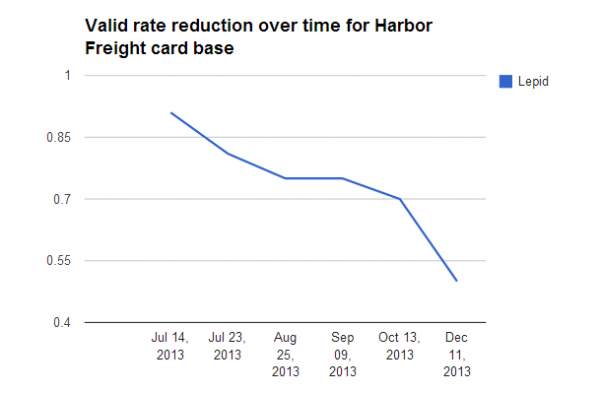

HARBOR FREIGHT

The same pattern can be observed in another major breach from 2013. Relying on much the same method I used to validate the Target breach, I approached several financial institutions to determine if other batches of cards sold by Rescator’s various shops could be traced to specific breaches in 2013.

Sure enough, it didn’t take long to identify the midsummer 2013 breach at Harbor Freight Tools as the source of at least two major batches (they are called “bases” in the card shops, not batches) of cards sold by Rescator’s shops last year. Beginning in late June 2013, Rescator began selling a base called “Lepid,” moving new batches of Lepid cards onto the market almost every week in chunks of 100,000 cards at at time.

Just as with the Target breach, the Lepid cards initially were advertised as 100 percent valid, and came with a hefty price tag. But by mid-July 2013, the valid rates had begun to dip down to 95 percent, most likely because by that time banks had begun seeing the fraud and cancelling cards. A month later, the valid rates were below 75 percent, and by the time the Target breach was disclosed in December, fewer than half of the cards were still active.

Prices on cards stolen in the Harbor Freight Tools breach fall as more cards come back declined.

In late July, Harbor Freight disclosed a breach of its payment card system that lasted for seven weeks between May 6 and June 30, 2013. The company has not said how many customer cards were stolen, but from the volume of Lepid cards pushed onto Rescator’s shop as well as those from other bases tied to cards all used at Harbor Freight during the breach time frame (including bases “Laurentius” and “Sidonius”), it’s likely to have been several million.

The data from both Target and Harbor Freight Tools raise several questions. For starters, why did the valid rate decline so much faster with the Target cards than with those stolen from Harbor Freight? After all, it took nearly six months for the valid rates on cards stolen from Harbor Freight to reach 50 percent, while we’re already fast approaching that rate with the Target cards just two months after that breach was disclosed. I’m guessing the obvious answer is most likely the correct one: That the Target breach simply received a great deal more attention, both from the media and from card-issuing banks nationwide.

Does this mean the Target and Harbor Freight breaches are connected? I have no idea, although I strongly suspect that Rescator and his merry band of thieves played a key role in both breaches — beyond merely offloading stolen cards. In several instances, Rescator himself referred to Lepid as “our” base, indicating the batch was from a firsthand source.

The analysis of some of the malware used in the Target breach suggests that Rescator may have been directly involved in that attack. I don’t have any such clues from the Harbor Freight breach; the company has not responded to requests for comment, and Mandiant — the forensics firm which was called in to investigate the Harbor Freight breach — declined to comment.

Finally, a number of folks with whom I’ve shared this research wondered why any cards that were suspected as stolen in the breach at Target would not already have been cancelled by issuing banks. It’s not clear how accurate Rescator’s valid rates are — certainly Rescator has a vested interest in fudging the numbers.

But assuming the percentages are relatively accurate, many factors could explain why some banks haven’t simply cancelled and reissued all cards potentially impacted in the breach. One source I spoke with earlier this year from a fairly larger card issuer said his institution still had not reissued at least 40 percent of their cards affected by the Target breach. The source said those cards generally fell into two categories: Cards that had only recently been reissued prior to the Target breach discovery, and those that were expected to naturally reach their expiration dates in the next month or so.

I should note that the above analysis ignores several million non-US cards stolen from Target shoppers and sold under the international “Barbarossa” label (the outlier in orange from the first graphic above), which at one time fetched prices in excess of $120 per card.

The post Sale on cards stolen in Target breach appeared first on Payments Cards & Mobile.

![Rescator[dot]so card shop announcing the availability of new bases of Target cards.](http://krebsonsecurity.com/wp-content/uploads/2014/02/rescatorvalid-600x639.png)